Specialty motorcycles are a unique breed within the industry that sets them apart from the rest. Custom bikes, choppers, and other one-of-a-kind marvels are more than just modes of transportation; they’re statements of individuality. With the help of The Motorcycle Insurance Guide, let us dive into the world of specialty motorcycle insurance, and discuss what factors to take into account when protecting your valuable asset.

Understanding Speciality Motorcycles

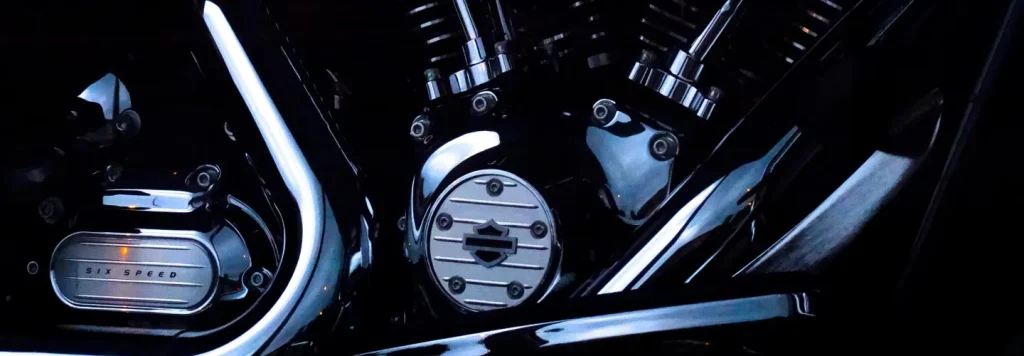

Specialty motorcycles, including choppers and custom bikes, come in all shapes and sizes, each reflecting the owner’s individual taste and preferences. From handcrafted frames to personalized paint jobs, these machines are a testament to creativity and craftsmanship. However, when it comes to insurance coverage, their uniqueness might also present a special challenge. It is important for owners to seek coverage because standard motorcycle insurance may not be sufficient to protect the customized features and higher value of these specialty bikes.

The Importance of Motorcycle Insurance for Your Unique Vehicle

Value Coverage

- Specialty motorcycle insurance often offers agreed value coverage. This means that, in the event of a total loss, you’ll receive a predetermined amount agreed upon when purchasing the policy, ensuring that your investment is properly protected.

Coverage for Customized Parts and Accessories

- Custom components and accessories are a common feature of specialty motorcycles, adding to their distinctive appeal. It’s possible that standard insurance plans won’t sufficiently cover these upgrades. You can explicitly list and insure these unique components with motorcycle insurance, guaranteeing that you will be paid for the full value of these items in the event of theft or damage.

Coverage for Modifications

- Specialty motorcycle insurance can cover modifications like installing custom handlebars, adding a unique exhaust system, or changing the engine. You could be vulnerable to losses if standard policies don’t cover aftermarket modifications.

Coverage for Transport Trailers

- Motorcycle insurance may cover the trailer and its contents if you use one to transport your specialty motorcycle. For people who travel to attend bike events like rallies, this extra protection is crucial.

Choosing the Right Motorcycle Insurance

It is important to take your needs and the special features of your motorcycle into account when choosing a specialty motorcycle insurance policy. Here are some things to consider:

Evaluation and Record Keeping

- Provide thorough records, such as pictures and evaluations, to make sure the special qualities of your bike are appropriately portrayed. This data is going to be very helpful if there is a claim.

Examine Policy Limitations

- Verify that the policy limits cover the value of your motorcycle in addition to any aftermarket additions, custom parts, or accessories.

Recognizing Exclusions

- Read the policy carefully to understand any exclusions or limitations that might be applicable. This will assist you in locating any possible coverage gaps and, if needed, investigating other options.

Specialty motorcycle insurance offers the customized protection you need to protect your investment and make sure you can keep riding with confidence. Spend some time considering your options, cataloging the special features on your bike, and deciding on a policy that compliments your love of riding. Reach out to The Feltner Group today to find out more about your options for specialty motorcycle insurance.