Having a custom bike is more than just a way to travel from point A to point B for motorcycle enthusiasts; it’s a way to showcase your craftsmanship, sense of style, and individuality. Given their distinctive designs, alterations, and one-of-a-kind touches, custom motorcycles frequently reflect the personality of their owners. Standard motorcycle insurance, however, might not be enough to safeguard your investment. Specialty motorcycle insurance is intended to make sure that these one-of-a-kind vehicles are adequately protected and reasonably priced.

Let’s go over some key factors for custom motorcycle insurance, such as valuation techniques, how coverage is affected by modifications, and advice on how to choose the best policy for your requirements.

Custom Motorcycle Valuation Techniques

A specialty motorcycle needs to be valued correctly in order to be covered. Market value, which is established by the property’s resale value at the time of a claim, is usually the basis for traditional insurance coverage. However, custom bikes sometimes include unique features, parts, and modifications that make market pricing an inadequate representation of their true worth.

Selecting an agreed value policy is typically a better option for custom motorcycles. With this kind of policy, you and your insurer decide on a fixed price for your bike based on expert assessments, the caliber of any custom work, and any changes. Regardless of depreciation or changes in the market, you will be compensated in full if the bike is lost or damaged.

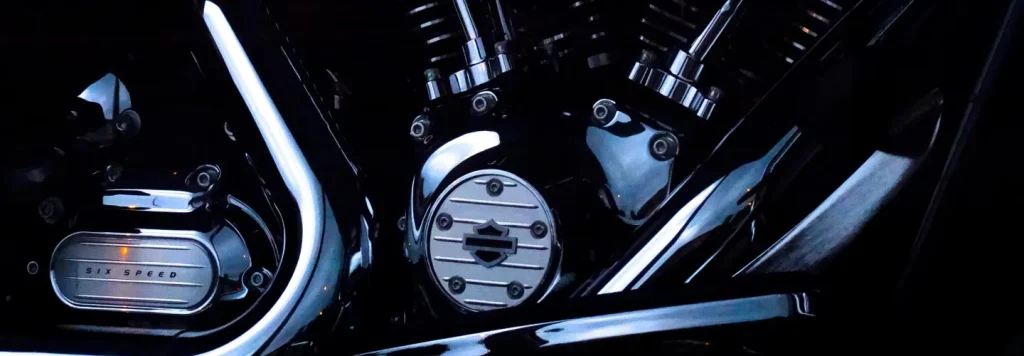

In order to determine the actual worth of your customized motorcycle, insurance companies could want an expert evaluation. Included in this should be a thorough evaluation of the bike’s state, a description of special modifications, and excellent pictures of the outside and inside aspects. Your customized vehicle will be appropriately assessed and insured thanks to a comprehensive evaluation.

Factors That Affect Your Specialty Motorcycle Insurance

Several factors can influence the insurance coverage and premiums for specialty motorcycles, such as custom builds, vintage bikes, or unique high-performance models. Here are some key aspects to consider:

- Age of the Motorcycle: The cost and kind of coverage you require may change depending on how often an older or vintage motorcycle needs repairs and specialized maintenance. Due to the expense of replacement and the level of skill needed for repairs, antique and rare parts may raise the total insurance price.

- Maintenance and Upkeep: To keep your specialty motorbike in insurable condition, proper maintenance is crucial. Your rates may be lowered by reducing the chance of malfunctions or damage through routine maintenance, prompt repairs, and consistent inspections. Because a well-maintained and well-documented motorcycle is less likely to be claimed, insurers may give lower rates.

- Storage Conditions: Your motorcycle’s insurance premiums can be greatly impacted by the location and manner of storage. It is usually better to store the bike indoors in a climate-controlled environment because it lowers the danger of theft and weather-related wear. Yet, exposure to severe weather or outside storage may raise premiums.

- Motorcycle Usage: The way you want to utilize your specialist motorcycle will also have an impact on your insurance requirements. Your needs for coverage will be different from those of a rider who attends motorcycle rallies or exhibits if you only ride your bike on occasion. You might require extra insurance to cover the additional dangers if you ride your bike in competitive events.

Purchasing specialty motorcycle insurance for your customized motorcycle allows you to rest easy knowing that your one-of-a-kind vehicle is protected. These options, ranging from agreed value policies to modification coverage, guarantee that your bike is insured for its actual value, protecting its legacy and worth. Specialty insurance is essential to protecting your investment and continuing to enjoy your vehicle for many years to come, regardless of your passion for custom designs.

We are committed to serving our clients’ best interests because we recognize that having so many options for specialty motorcycle insurance coverage can be overwhelming. We don’t represent insurance companies, and we won’t pressure you into getting a coverage that doesn’t meet your company’s requirements. If you’re in the greater Rochester area, reach out to The Feltner Group today to speak with a broker and get your coverage started.