In our workers’ comp 101 guide, you can learn about important ideas and legal rights for you and your employees.

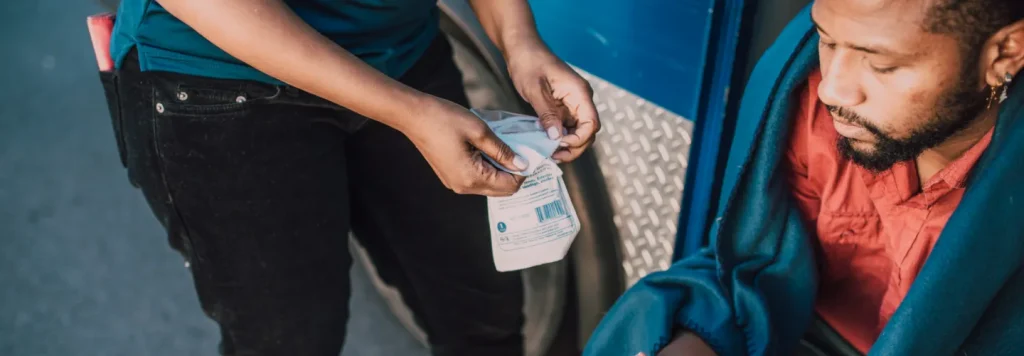

Even though you take precautions to protect your employees from illnesses and accidents at work, the unexpected can still occur. When it does, workers’ compensation insurance can benefit your staff while assisting in the financial security of your company. You must have it, as almost all states mandate that you do. With the help of Travelers Insurance, here is what you should know:

What is Workers’ Compensation Insurance?

Workers’ Compensation insurance can assist in covering related medical and rehabilitation costs. It also reimburses an employee for lost wages or if they become disabled for a prolonged period of time. When medically necessary, it facilitates a safe return to work. In exchange, if an injured employee receives Workers Comp benefits, they are prohibited from suing you for additional compensation. Workers Comp insurance safeguards you from potential lawsuits for those benefits by paying those benefits to the injured employee.

Is It Necessary?

In most states, having worker’s compensation insurance is required by law and is strongly advised even without it. Typically, if a W-2 is issued, workers’ compensation insurance is required. The Workers’ Compensation system is governed by state legislation, so each state has its own set of requirements for benefit coverage and fines for failing to properly protect your employees.

In California, for instance, you are required to obtain Workers’ Compensation insurance as soon as you have one employee. Similarly, the state of New York has the authority to impose a $2,000 fine on an employer for every 10 days of non-compliance. To avoid paying fines for not having Workers’ Compensation insurance, it is best to consult your insurance agent or the labor department in your state.

How Can I Buy It?

Your workers’ compensation insurance premium is affected by a number of variables. Your business type, the number of employees you have, their combined salaries, and your history of workplace accidents all have an impact.

A premium could increase as you add more covered employees and as their salaries increase. This is due to the fact that workers’ compensation benefits replace a portion of an employee’s income after they become disabled, making a higher-salary person potentially more expensive to insure. For more hazardous jobs and industries, Workers Comp insurance may also be more expensive. A construction company, for instance, should be prepared to pay more than a retailer. The amount of workers’ compensation claims made by your staff will be assessed over time by your insurance provider. When there are fewer claims, the policy may be discounted. Whereas if there are many claims, the reverse could be true.

Before you enroll in coverage, your insurance agent might be able to give you an idea of how much your policy will cost for the entire year, and assist you in creating a budget.

Does It Cover All Legal Risks?

Even if you have workers’ compensation insurance, an employee may occasionally sue you for a workplace incident. As an example, consider the situation where an employee who is not covered by the workers’ compensation law claims that your negligence led to the incident. In situations like this, workers’ compensation insurance is frequently combined with additional employers’ liability insurance. This may further cover legal expenses, including a potential settlement, for employee workplace accidents that might not be covered by a typical workers’ compensation policy. When you purchase your Workers’ Compensation policy, you can add this additional coverage.

Your greatest resource is your workforce. Workers’ compensation insurance helps to safeguard them and to support you. This way each party can continue to concentrate on expanding your company. Consider getting in touch with The Feltner Group to set up a workers’ compensation insurance policy if you’re ready to explore your options.